Krugman identifies that “Greece [became] the disaster austerians were looking for,” such that in 2009, increased borrowing costs put pressure on Greece to reduce fiscal stimulus and enact austerity. In fact, Greece was borrowing at only 1.3 percentage points higher than that of Germany in September 2009, a gap that increased sevenfold by September 2010.

In the middle of 2009, as a result of the financial crisis, the recession bottomed out as most economies began recovery, albeit with below optimal output and employment levels. Interestingly, policymakers decided on a doctrine of “expansionary austerity,” largely a result of Alberto Alesina’s work, indicated that austerity was often “associated with economic expansions rather than recessions.” This was a result of increased consumer confidence negating the negative effects of a reduction in the required levels of Keynesian fiscal spending to stimulate the economy.

Krugman turns to “Growth in a Time of Debt (pdf),” a paper by Carmen Reinhart and Kenneth Rogoff that takes a multi-country historical data set to examine the relationship between government debt and real GDP, whether emerging markets face a lower threshold of external debt (public and private), and if a contemporaneous link between inflation and public debt levels for advanced countries exists. While the paper had difficulty in finding more than two to three decades of public debt data, a time series was created from the IMF’s SDDS resulting in data beginning as of 2000.

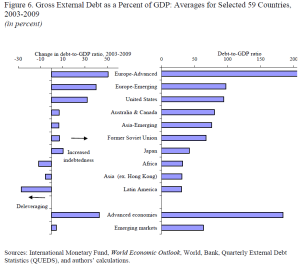

The paper’s findings are especially important in our current period of rising government debt, especially among “epi-center countries.” It found that the relationship between public debt and economic growth is surprisingly similar between emerging markets and advanced economies. For the five countries with systematic financial crises (Iceland, Ireland, Spain, the US, and the UK), average debt levels are expected to rise above the 86% benchmark suggested by Reinhard and Rogoff in their previous works 1 (pdf) and 2. Rising average debt levels have been a result of bail-out costs, fiscal stimulus packages, and declines in government revenue. In fact, empirical evidence indicates that “there is no obvious link between debt and growth until public debt reaches a threshold of 90%,” a fact that is particularly disconcerting when you realize that emerging markets depend much more on external borrowing than do advanced economies, as noted in Figure 6 (below).

In Figure 6, it shows that from 2003–2009, gross external debt (private and public) as a percentage of GDP shows that advanced economies and emerging markets have, on average, increased indebtedness. In fact, advanced economies have grown their indebtedness level to almost 4 times that of emerging markets. However, a more accurate assessment would require a country-specific case study, e.g. the US’ gross debt liabilities are less than half of European’s as a share of GDP, and Japan has much smaller gross external liabilities due to a home bias in bond holdings. Therefore, high indebtedness in advanced economies could be a result of advanced economies issuing most external debt in their own currency. Therefore, the eventual need for deleveraging “may further dampen growth in the medium-term.”

However, it leaves to question what long-run macroeconomic impacts exist as a result of higher government debts, especially in light of an aging population and rising social insurance costs. In the long-run, Reinhard and Rogoff indicate that “Any government that attempts to inflate away the real value of short-term debt will soon find itself paying much higher interest rates [to service these debts].” An important historical debt-to-GDP distinction the paper draws is peacetime vs. war-time debt explosion. Historically, “postwar growth tends to be high as war-time allocation of manpower and resources funnel back into the civilian economy,” such that debt explosion during peacetime eras “often reflects unstable underlying political economy dynamics that can persist for very long periods.” While Reinhard and Rogoff do not specify a time frame, it is estimated that the US Fed will need until 2025 to wind down its QE1 -3 packages.

Reinhart and Rogoff conclude that “Seldom do countries simply “grow” their way out of deep debt burdens.” As mentioned earlier, empirical evidence of debt-to-GDP broke through the previous 86% benchmark, but the paper merits further research to examine why there are thresholds in debt, and why, empirically speaking, 90% has become a benchmark. Similar to the near zero interest-rate environment we have, are we ushering in a new era of external debt levels? Reinhard, Rogoff, and Savastano examine in “debt tolerance” that debt thresholds are importantly country-specific, such that the IMF’s four broad debt groupings merit further sensitivity analysis. Most importantly, the paper highlights that “as debt levels rise toward historical limits, risk premia begins to rise sharply, facing highly indebted governments with difficult tradeoffs.”

Krugman uses the “Growth in a Time of Debt” paper to justify academically the “expansionary austerity” work of Alesinia. The paper further exacerbated the consensus that austerity was required, as “high debt is very, very bad.” Therefore, the paper could not have been published at a more important time to assist policymakers in their push for austerity, such that “Fiscal retrenchment could be presented as urgently needed to avert a Greek-style strike by bond buyers.”