In Thursday’s Bloomberg Brief: Economics Asia (pdf), it discussed the vulnerabilities of emerging markets in Asia ahead of an (un)expected hike in the Fed Funds Rate. An announcement is expected to be made on June 17th after the FOMC meeting for June 2015.

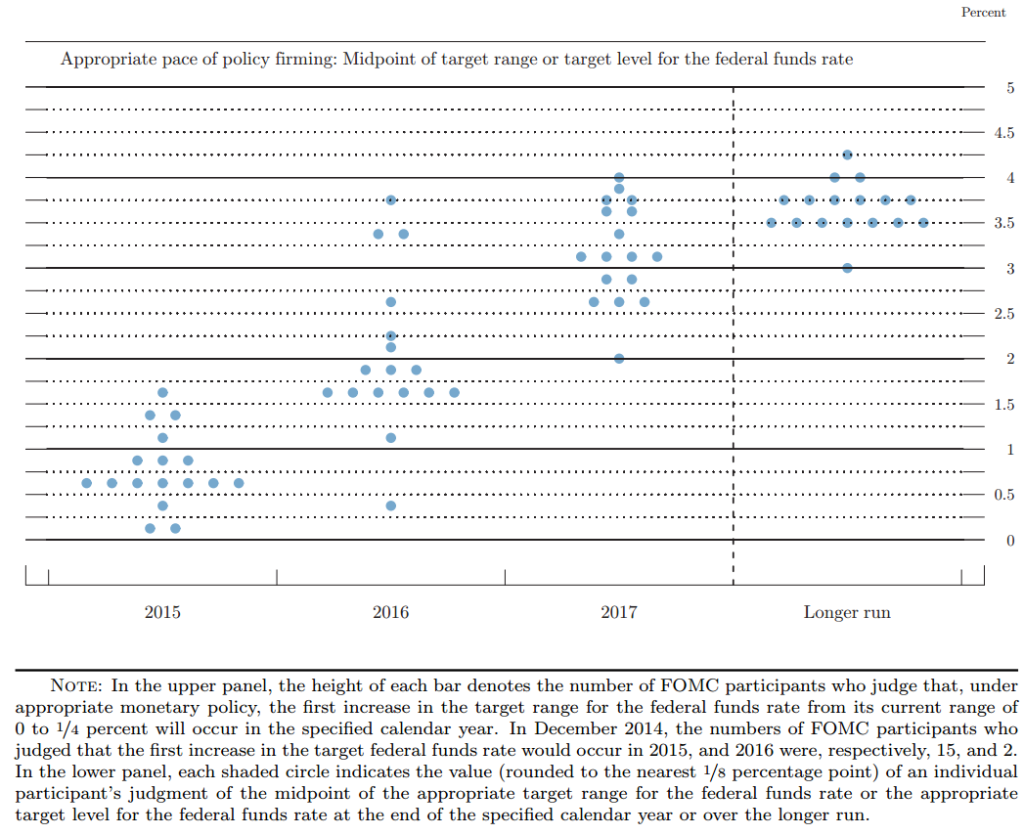

The March 2015 economic projections (pdf) by the FOMC indicate a hike in the near-term:

The above economic projections are in support of the sentiment that the FOMC has been giving in their monetary policy release immediately after their meeting. Below is the second-half of the third paragraph of the press release from January 28, March 18, and April 29 respectively:

- January 28: Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy. However, if incoming information indicates faster progress toward the Committee’s employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.

- March 18:Consistent with its previous statement, the Committee judges that an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. This change in the forward guidance does not indicate that the Committee has decided on the timing of the initial increase in the target range.

- April 29: The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

I have previously mentioned how Eric Lui (Hong Kong Economic Journal) has remained skeptical on a Fed Funds hike, as his March 19 article stated, “the historical ratio of three-month treasury yield versus monetary base/nominal GDP shows that if the short-term yield returns to the normal level of 2 percent, the Fed will have to contract as much as 50 percent of its assets, which is equivalent to US$2 trillion and represents over 12 percent of its GDP.” Lui further supports his stance in his March 26 article, “The latest rate of Fed Fund futures shows that the market now expects a delayed rate hike as a result of recent remarks by chairwoman Janet Yellen. The current market has priced in a first rate hike late this year or January 2016. However, the longer-term futures rate continues to rise, a sign that the market still expects a rate hike sooner or later.”

As a further follow up, Lui’s May 14 article (published in HKEJ on March 13) sums up our current economic climate in a nutshell, “investors have been forced to buy long-duration government bonds and even high-yield debt given that major central banks have already snapped up available short-duration bonds. As a result, yields of short-duration bonds eased to below zero, and those of longer-duration bonds also touched record lows. The bond market has seen hectic trading as major central banks continued their intervention in a bid to brighten the gloomy economic outlook. However, the US dollar started to ease in early April, while crude oil price rebounded by more than 40 percent, thus raising expectations for inflation. The improving economic outlook in the eurozone, together with warnings issued by Fed chair Janet Yellen about the high bond valuations, triggered a bond sell-off. The spiking bond yields also highlight a structural issue, the trade liquidity risk in the bond market, which leads to a policy paradox for the Fed. The market is flooded with liquidity as central banks undertook QE programs and adopted a zero interest rate policy. This abundant liquidity has inflated the prices of various asset classes and created several crowded-trading markets. The bond market is one of them. If the Fed opts for normalizing the interest rate, it could trigger a massive sell-off of bonds. However, sellers may struggle to find sufficient buyers for lack of liquidity, which might lead to a repeat of the AIG case in 2009 and trigger a new and broader financial crisis.”

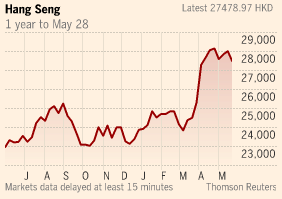

So what has happened to the Hang Seng Index since March 2015? (Click on image to enlarge)

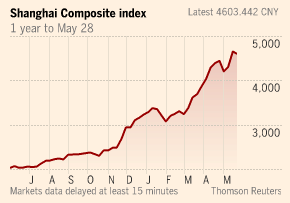

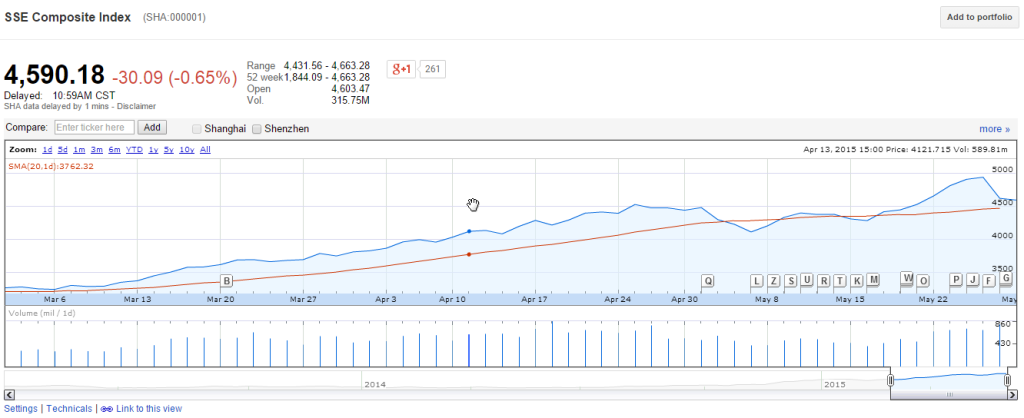

Has this been a push from the stock exchanges north of the border? Since March 2015:

If so, why the sudden push? In an FT article yesterday, “This year’s stunning rise in Chinese share prices experienced a dramatic shift in fortune on Thursday, with the Shanghai market recording one of its steepest declines in 15 years… The speed at which many stocks have risen to dizzying valuations has prompted widespread concerns that the market is in a bubble and the decline in prices on Thursday may mark the start of a broader correction that some say is long overdue. However, some also cautioned that such sharp corrections are typical in China’s fast-paced, retail-driven market… Volatility is likely to remain high over the coming days, added Mr Perrin, ahead of a slew of initial public offerings next week that are likely to lock up trillions of renminbi as investors look to punt often lucrative new listings.”

What does this year’s stunning rise in the HSI and SSE looked like?

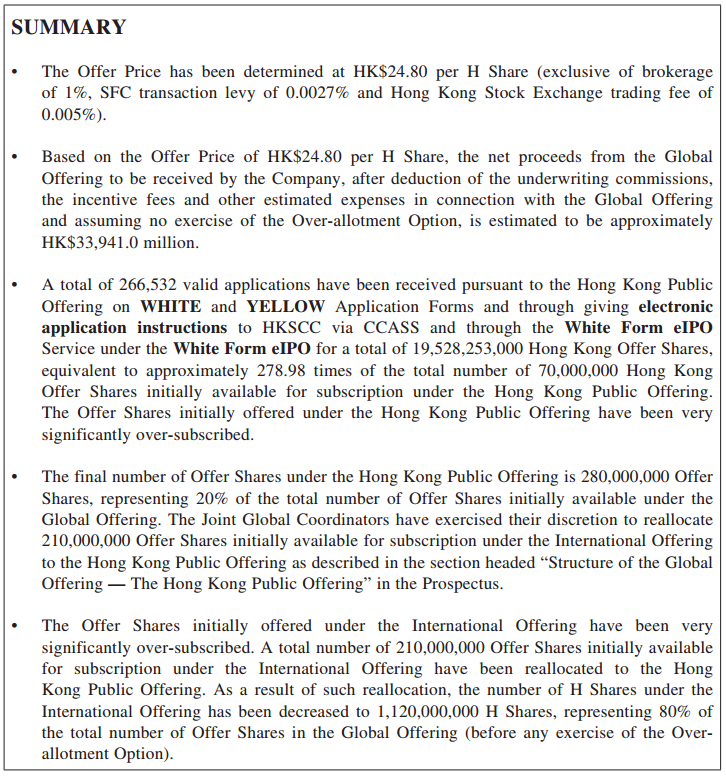

One of these ‘lucrative’ new offerings has been Huatai Securities. This morning, the HKEx released the brokerage’s IPO allotment results:

At the beginning of the week, the FT released an article on Monday “China brokers’ capital rush fuel margin-fed rally,” which said “The frenzied rallies in Shanghai and Shenzhen this year have been largely fuelled by margin lending where loans to invest in the market are secured against the stocks purchased… Margin-financed long positions in the onshore A-Share market now total Rmb1.9tn, or $307bn — up 84 per cent this year, and four times the level this time last year, according to Macquarie analysts. The sharp rise has stoked fears it could reverse almost as quickly: if the value of margin-financed portfolios were to fall, lenders would demand more collateral or reduce the size of loans, either of which could trigger forced selling.”

At the beginning of the week, the FT released an article on Monday “China brokers’ capital rush fuel margin-fed rally,” which said “The frenzied rallies in Shanghai and Shenzhen this year have been largely fuelled by margin lending where loans to invest in the market are secured against the stocks purchased… Margin-financed long positions in the onshore A-Share market now total Rmb1.9tn, or $307bn — up 84 per cent this year, and four times the level this time last year, according to Macquarie analysts. The sharp rise has stoked fears it could reverse almost as quickly: if the value of margin-financed portfolios were to fall, lenders would demand more collateral or reduce the size of loans, either of which could trigger forced selling.”

The article further pushes the idea of an anticipated 2016 bubble, as “Yet more than half of the $9.5bn of equity raised in Hong Kong this year by brokers will be used to finance more margin loans, according to the companies’ filings. [Such that,] “Brokers are the perfect stock in this market — they’re a leveraged derivative on what’s going on in China,” said one equities banker, who described the mainland rally as a “state-sanctioned bull run”.” In support of the views by the Bloomberg Brief, the article highlights that ““This capital is being immediately redeployed, there’s no cash drag and they’re not accumulating a war chest,” said one banker involved in the deals.“