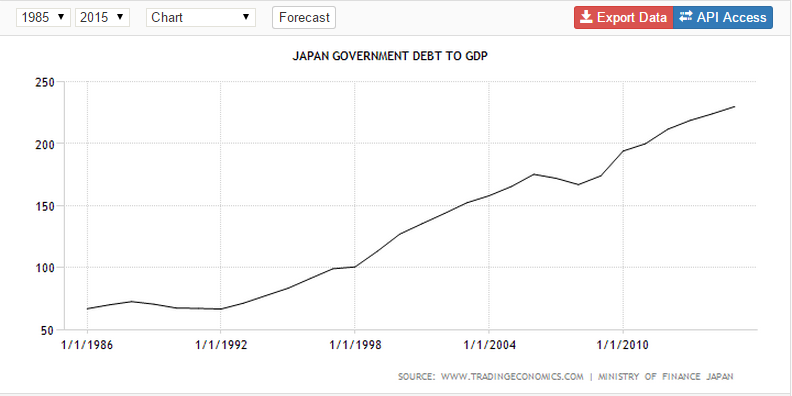

If the level of Japanese government debt is continuing to rise, why are they continuing to issue greater levels of debt? The below graph shows the rising level of debt-to-GDP between 1985-2015 in Japan:

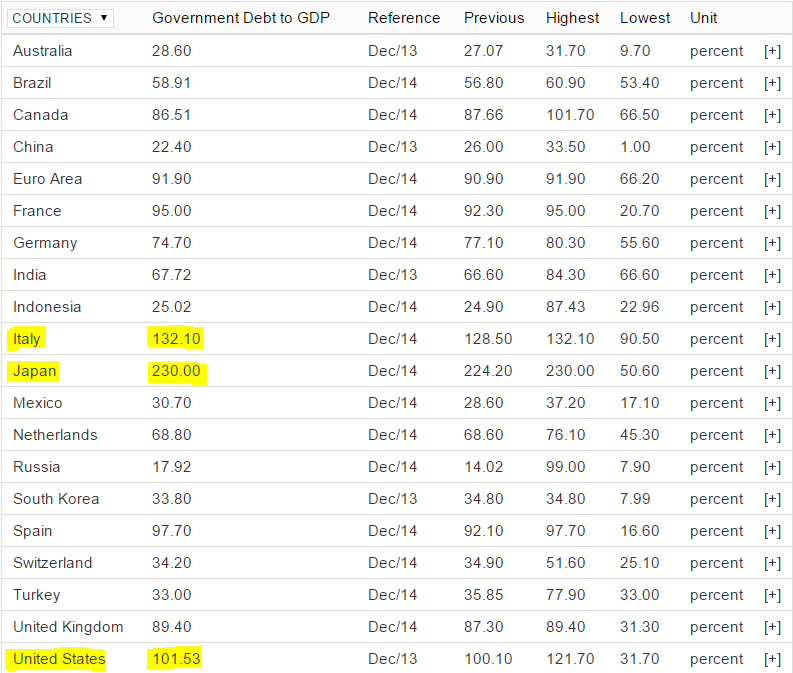

At its lowest level, debt-to-GDP was 50.60% in 1980 but has consistently risen since and reached an all-time high of 230% in 2014. So how does Japan compare with other developed economies?

So what does the national debt of Japan look like? As of 10:15am on June 26th, 2015, it looks like this:

As the Globe and Mail (G&M) recently put it:

- “At 233 per cent, Japan is known to have the highest ratio of debt to gross domestic product (GDP) among the world’s most advanced economies. Greece’s figure, at 177 per cent, seems small by comparison…Unlike Greece, however, there is no sign of fiscal crisis in Japan and the markets seem to confirm it: Interest on a 10-year Japanese government bond is a meagre 0.3 per cent, and the premium on a credit default swap of these bonds, proxy for the probability of default, is hovering around 0.4 per cent. This means that markets are predicting Japan’s default once in 250 years.“

However, the G&M points to three factors:

- Japan owns approximately 65-trillion yen worth of assets, which puts the debt-to-GDP ratio closer to 100%. Thus, if you owe a lot but also own a lot, the amount you owe is partially offset by the amount you own (depending on its liquidity).

- Since the mid-1990s, economic stagnation has meant that government revenues and taxes have been misquoted, as they depend on the size of nominal GDP figures, which has not been adjusted for deflation.

- The aging-population of Japan has further burdened the somewhat social-welfare state through increasing pension, medical and elderly-care related expenditures. Thus, one way to continue paying for these expenditures has been through government borrowing.

Is there an end in sight? Earlier in 1997, the government raised its consumption taxes from 3% to 5% and this move proved premature and backfired on the economy. Earlier in 2014, the National Tax Agency hiked the consumption tax to 8%, and is ready to raise it to 10% by October 10%. In fact, the IMF have projected that Japan’s debt-to-GDP will rise to 250% by 2020 if the current fiscal policy remains. So if there is no end in sight, what does the G&M take away from the case of Japan?

First, deflation is dangerous, whether for a state’s economy and/or finances. As the Economist points out the potential vicious cycle resulting from deflation:

- “The nominal interest rate cannot fall below zero, because that would mean reducing savers’ bank balances every month, and would prompt them to withdraw their deposits from banks and stash cash under the bed. Together with inflation, this puts a floor on the real interest rate too. If inflation is low and real rates can’t fall far enough to boost demand and perk up prices, demand will weaken still further. This is the dreaded deflation trap. There are other problems, too. Lower-than-expected inflation increases the real burden of debts. Lenders benefit, but because they are more likely to save than borrowers, demand is sapped overall. Deflation also increases rigidity in the labour market. Workers are resistant to wage cuts in cash terms, but inflation lets firms cut real wages by freezing pay in nominal terms. Deflation, by contrast, makes this problem worse.To avoid the trap, central banks can resort to unconventional policies such as quantitative easing, although there is debate over their fairness and efficacy. In the long run, some economists think inflation targets should be higher. That would give more room for real interest rates to fall when economies are hit by negative shocks. But in a few decades, the problem may disappear: in a cashless economy it is impossible to stash money under the bed. That would allow nominal interest rates to go negative, as everyone’s bank balance could simply be reduced simultaneously. But that might be easier said than done.“

Second, if your economy is in stagnation, pursuing austerity may not be the best course of action, economic growth is, yet did quantitative easing (QE) work for Japan? QE began in Japan in 2001 to combat deflation. This resulted in the Bank of Japan (BOJ) flooding domestic commercial banks with excess liquidity, which amounted to an increase in commercial bank current account balances inflating from 5 trillion yen to 35 trillion yen over a four-year period starting 2001. Currently, the BOJ is pursuing its “Quantitative and Qualitative Monetary Easing” program that is set out in four areas:

- Monetary Base Control: “The BOJ will conduct money market operations so that the monetary base will increase at an annual pace of about 60-70 trillion yen.“

- JGB purchases: “the Bank will purchase JGBs so that their amount outstanding will increase at an annual pace of about 50 trillion yen.“

- ETF and J-REIT purchases: “the Bank will purchase ETFs and Japan-REITs so that their amounts outstanding will increase at an annual pace of 1 trillion yen and 30 billion yen respectively.“

- Continuation of QQE: “The Bank will continue with the QQE, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner.”

Third, the G&M point out a fact that addresses most advanced economies: an aging-population, something that the Hong Kong government have expertly steered themselves away from having major expenditures towards.

In the OECD’s April 2015 Economic Surveys, the main findings for Japan were the following:

- Japan has the highest debt in the OECD and this increasing debt is pushing up the nation’s debt service costs (overlay required to cover the repayment of interest and principal on its debt).

- Economic growth must be achieved through ‘bold’ structural reform. The OECD point to the ‘third arrow’ of Abenomics: raising output growth through fiscal consolidation (austerity) and improved living standards.

- Top fiscal priority is reducing government debt, i.e. good luck. While “public debt remains on an upward path. The impact of the high debt is mitigated by low long-term interest rates, but weakening confidence would cause interest rates to rise substantially. A run-up in interest rates would increase debt rapidly and destabilise the financial sector and the real economy.“

- End deflation, a problem that Japan has had since 1989.

So what does this all mean for yields on JGBs?

There is some consensus that yields will rise in the longer-term as a result of the quantitative easing efforts by the BOJ. Furthermore, the expected hike in Fed funds rate in early 2016 should reverse the trend of JGBs yields, as CNBC indicates. However, the initial problem for corporate bond issuance, as indicated by Mana Nakazora (chief credit analyst at BNP Paribas), is that, “they (corporations) can’t see where they are going to secure returns after 2015 and beyond, or when the BOJ will end the current round of quantitative easing and stop buying JGBs… [and furthermore,] 95 percent of JGBs are held by Japanese investors – and that provides the government and the BOJ with some additional room to breathe.”

And what should we take from all this? I expect the level of Japanese debt-to-GDP to remain on its path until approximately 2020, as the Economist points out:

- “Another answer is that there may come a time to worry about debt, but now is not it.“

- “But at this point, the debate over what Japan should do about its debt is somewhat absurd. No amount of fiscal rectitude is going to get Japan out of its long-term rut. And so long as Japan is in its long-term rut government debt will build and will find its way onto the balance sheet of the Bank of Japan. It is hard to see how tax increases that undermine the effort to beat deflation serve anyone’s purpose. They are paving the road, it should be clear, to something even less familiar and more bizarre than Japan’s current straits: the monetisation of a massive amount of government debt with no inflationary consequences.”