In the aftermath of the financial crisis, nearly all OECD countries were running significant budget deficits, especially that of the US as a result of its fiscal response. A fiscal response can occur either through changes in government spending or taxes. However, contrary to conventional thinking, the IMF’s chief economist, Oliver Blanchard, pointed out that austerity measures (tax hikes and/or spending cuts) have caused more economic damage than anticipated, as highlighted in their 2014 World Economic Outlook (PDF). Further to this, Krugman confirms that all previous economic research that supported the austerity push has now been discredited.

As previously highlighted, a response to temporary changes in the economy can be faced through cutting interest rates to encourage spending, especially on housing, which is why the US were so consistently concerned about the economic indicator: housing starts. However, by late 2008, conventional monetary policy became obsolete in the face of near zero interest rates, and fiscal expansion (government spending or tax cuts) was near impossible in the face of budget deficits. In response to this, Krugman identifies the inconvenient truth that “Conservatives like to use the alleged dangers of debt and deficits as clubs with which to beat the welfare state and justify cuts in benefits.”

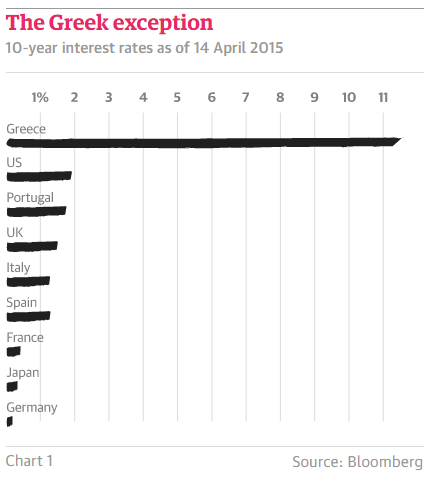

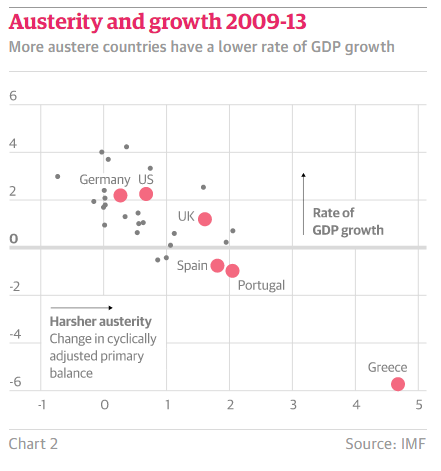

In Chapter 3 of ‘The Austerity Delusion’, Krugman explains what happened to austerianism through his two charts:

In his above chart (Chart 1), Krugman reaffirms his point that “Greece is now seen as it should have been seen from the beginning – as a unique case, with few lessons for the rest of us.” It shows that according to interest rates on 10-year bonds, as of mid-April 2015, that Greece, in comparison to other OECD countries, is paying significantly higher interest rates on its debt (as previously mentioned). Further to this, Krugman highlights that other countries are “paying very low interest rates by historical standards… It includes Spain and Italy, which faced a financial panic in 2011-2012… And it includes Japan, which has debt more than twice its gross domestic product yet pays even less [than Greece].”

Furthermore, Krugman’s point that Greece is a unique case is as a result that the US, UK, and Japan can borrow in their own currencies, thereby allowing his myth of the “invisible bond vigilantes” to hold. You can read his model drawn over a brief airplane ride here.

In his second chart (Chart 2), Krugman plots the rate of GDP growth (y-axis) to degree of austerity measures (x-axis), and each red dot represents the experience of an advanced economy from 2009 to 2013, as 2013 was the last year of large spending cuts. The degree of austerity measures “the average annual change in the cyclical adjusted primary surplus, an estimate of what the difference between taxes and non-interest spending would be if the economy were at full employment.” Further to this, Krugman believes that the turn towards austerity was simply “a great natural experiment,” such that, fiscal adjustments usually occur in an overheated economy suffering from inflation or in the aftermath of wartime, not during peacetime. Whether you believe the US and UK are currently engaged in wartime vs. peacetime should be left to your own imagination.

The chart makes the truth painstakingly obvious: a negative correlation exists, such that harsher austerity measures result in a lower rate of GDP growth. This confirms Krugman’s belief in the “confidence fairy”, a term that describes the false manner in which austerity measures were meant to stimulate consumer confidence.

As previously mentioned, a nation’s debt levels should be considered in light of peacetime vs. wartime, a point drawn from Growth in a Time of Debt (PDF). In ‘Large Changes in Fiscal Policy: Taxes versus Spending‘, Alberto Alesina and Silvia Ardagna take this point one step further and examine changes in fiscal policy (fiscal stimuli and adjustments) in OECD countries between 1970 and 2007. However, Krugman criticizes that the 2010 paper “wasn’t very good statistical work. A review by the IMF (PDF) found that the methods Alesina used in an attempt to identify examples of sharp austerity produced many misidentifications.” Let’s examine why.

The 2010 paper examines “whether tax cuts or spending increases are more expansionary, is a critical one, and economists strongly disagree about the answer.” The paper examines this in light of ‘fiscal multipliers’, namely: how much one dollar of tax cuts or spending increases translates in terms of GDP. There is an important political dimension involved, as “right of center economists and policy makers believe in tax cuts and the left of center ones believe in spending increases.” Furthermore, the paper insinuates that policy making is a zero-sum game in that “both sides also wish to “sell” their prescription as growth enhancing and more so that the other policy. Unfortunately, both sides cannot be right at the same time!”

Historically, the 2010 paper indicates that the US successfully reduced its large public debts in the period of post-WWII and in the 1990s when “without virtually any increase in tax rates or significant spending cuts, a large deficit turned into a large surplus.” This was a similar case in the UK, as had a “credible fiscal stance, and the debt was gradually and relatively rapidly reduced.” This indicates that a reduction in public debts is largely sustained through economic growth, an outlook few could take at this moment in time. Therefore, if “growth alone cannot do it and inflating away the debt carries substantial risks, we are left with the accumulation of budget surpluses to rein in the debt in the next several years in the postcrisis era.” This leaves us with the question of whether a tax hike or spending cut will result in a more stable fiscal outlook.

Results of the 2010 paper suggest that “tax cuts are more expansionary than spending increases in the cases of a fiscal stimulus. For fiscal adjustments we show that spending cuts are much more effective than tax increases in stabilizing the debt and avoiding economic downturns.” However, as the paper uses empirical evidence to evaluate fiscal adjustments, this is precisely where Krugman criticizes the identified examples of sharp austerity measures, such that they produce many misidentifications, e.g. “we uncover several episodes in which spending cuts adopted to reduce deficits have been associated with economic expansions rather than recessions.”

Results of the vector autoregression model will not be discussed here, as even the authors conclude, “Rather than reviewing our results again, it is worth elaborating, or perhaps speculating on, the current and future fiscal stance in the United States.” While Krugman perhaps disputes the merits of both the paper’s methodology and definitions, there are key facts that the paper concludes with.

The first: a significant portion (12%) of GDP deficit in the US is a result of the fiscal stimulus needed to prevent a depression after the financial crisis. The paper indicates that 2/3 of the fiscal package constituted fiscal spending and the rest as tax cuts. This distinction is important as the level of savings of American families pre-financial crisis was extremely low, meaning that a tax cut after the financial crisis would have posed little benefit.

The second: the paper satirically indicates that “After the “perfect storm” of this current crisis, the United States will emerge with an unprecedented (for peacetime) increase in government debt.” As for economic growth, it is unlikely “that these deficits and debt will disappear simply because growth will resume at a very rapid pace very soon.” The paper identifies several suppressions to growth: eventual interest-rate hike and spending cuts.

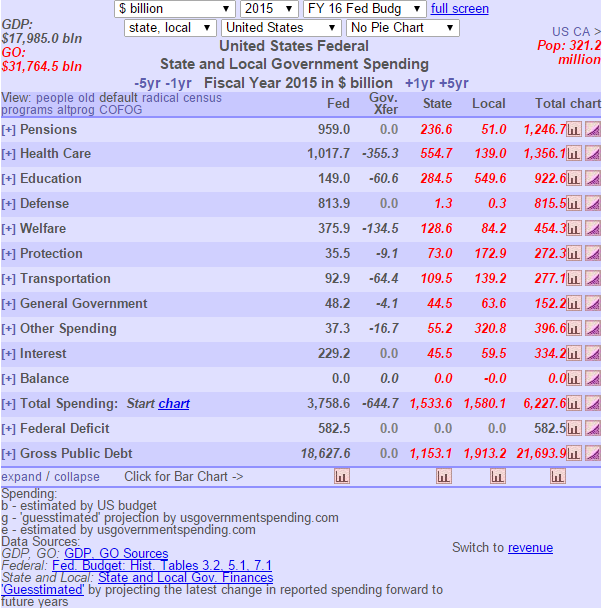

In the above table, a screengrab from the US government spending website supports the paper’s concern for the US budget deficit. It shows that for the 2016 fiscal year budget, reforms on health care spending and a much needed peace process in Afghanistan and Iraq is needed to help move the US towards a path of fiscal budget recovery. Furthermore, spending on pensions being at over $1.2467 trillion is bound to increase in the near future as the retirement of baby boomers is not too far off. The paper quite rightly concludes that unfortunately, “This is not a rosy scenario.”

In the above table, a screengrab from the US government spending website supports the paper’s concern for the US budget deficit. It shows that for the 2016 fiscal year budget, reforms on health care spending and a much needed peace process in Afghanistan and Iraq is needed to help move the US towards a path of fiscal budget recovery. Furthermore, spending on pensions being at over $1.2467 trillion is bound to increase in the near future as the retirement of baby boomers is not too far off. The paper quite rightly concludes that unfortunately, “This is not a rosy scenario.”