On Krugman’s NY Times Op-Ed ‘The Conscience of a Liberal‘, he released “US External Debt: A Curious Case” on May 3rd, 2015, largely in response to Timothy Taylor’s “The US as a Debtor Economy.”

Both Taylor and Krugman are questioning the current net international investment position (NIIP) of the US. The NIIP is the difference between a nation’s external financial assets and liabilities, or as Krugman puts it, “the difference between US assets abroad and foreign claims on the US.” More importantly for the US, a country’s external debt (liabilities) includes both government and private debt; such that, a country with a negative NIIP indicates that it is a debtor nation who is running a trade deficit and imports more than it exports.

Taylor points out that a negative NIIP is “a country [that] runs a trade deficit and imports more than it exports, like the US economy, producers in other countries are by definition receiving a greater value in US dollars from selling in the United States than the value of the foreign currency that US producers are receiving from exporting abroad.” As the US dollar is the world reserve currency, “these US dollars are invested or loaned back into the US economy.” However, over the long-term, Taylor identifies that this indicates “the total amount that foreigners have invested over time in the US economy is greater than the total amount that US investors hold in the economies of other countries.” This sounds like a win-win for the US? Not quite.

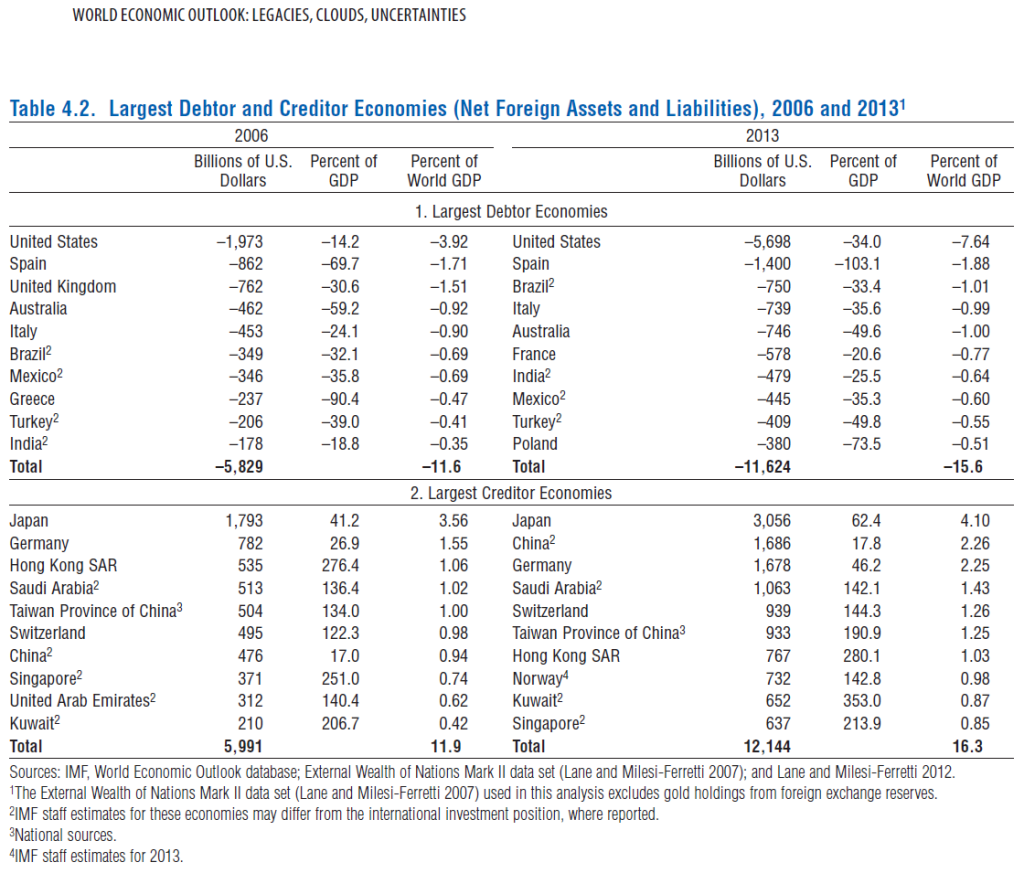

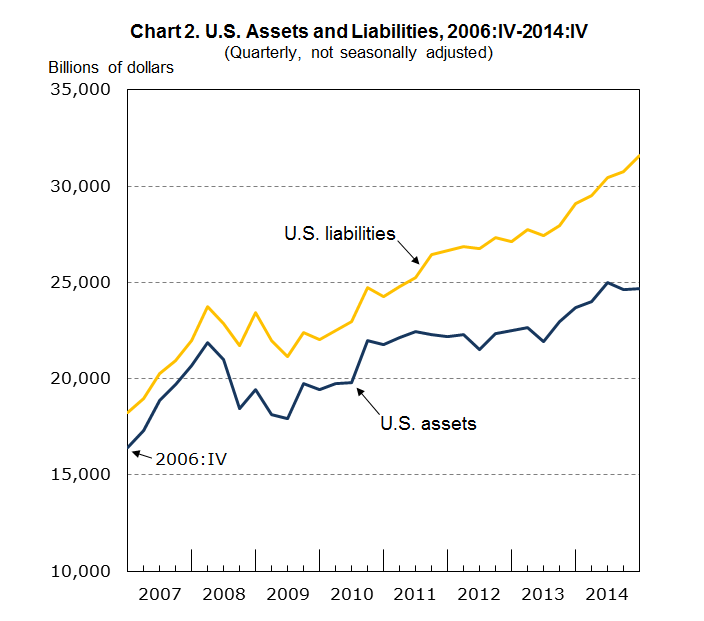

In the table above, Taylor draws from the IMF’s IMF 2014 World Economic Outlook (PDF) data, specifically Table 4.2 on page 130, that shows the US as the largest debtor nation in the world, and by a long shot at US$5.7 trillion, representing 34% of its GDP and 7.64% of World GDP. Taylor finds that within the US NIIP, the gap between US assets and liabilities has been increasing, as the US Bureau of Economic Analysis indicates below.

While it is no secret that foreign ownership of the US agency market has grown, what has become so worrying about this? According to the US Council on Foreign Relations, their first Quarterly Update of 2015 showed that in terms of foreign ownership of US treasuries (as a percentage of the total market value), “foreign investors now own more than half of the total market, with a large share of that in “official holdings” by foreign governments.” Further to this, the US Federal Reserve indicates an upward trend in foreign holdings of US corporate debt and equities, as below indicates.

Taylor concludes that while it may be fallacious to assume that a run on the US economy would eventually occur, he questions the extent to which the US as a debtor economy should become a cause for concern. Further to this, Taylor concludes that for now, “what seems to be happening in the global economy is that the US is a producer of what investors all around the world regard as safe financial assets: meaning US Treasury debt, as well as government-guaranteed debt backed by mortgages and corporate debt. Meanwhile, US investors abroad are more likely to make higher-risk, higher-return investments in equities or ownership of foreign assets.”

As the IMF indicates on page 135-136 in its 2014 World Economic Outlook, this ‘sweetspot’ can only last for so long:

- “Among the major debtors, the key exception to the trend of diminishing vulnerability is the unique case of the United States, whose net foreign liability position is projected to deteriorate from 4 percent of world GDP in 2006 to 8.5 percent of world GDP in 2019. Indeed, one of the concerns with growing global imbalances in the mid-2000s was the (admittedly remote) possibility of the U.S. liability position suddenly reaching a tipping point, after which private and public holders of U.S. assets would lose confidence, and the U.S. dollar would lose its reserve currency status. The U.S. net liability position in fact worsened to almost 8 percent of world GDP in 2013, but for a number of reasons, the likelihood that the dollar will lose its reserve currency status seems substantially lower than it did eight years ago. First, projected flow deficits of the United States are now considerably smaller than they were in 2006. Second, the U.S. dollar continues to be the leading transaction currency in foreign exchange markets and a key invoicing currency in international trade. It accounts for a dominant share of all outstanding debt securities issued anywhere in the world and especially of those securities sold outside the issuing country in a currency other than that of the issuer. Third, dollar assets held in central bank reserves are not excessive in relation to central banks’ “optimal” currency portfolios.Fourth, at present, the dollar has relatively few competitors, since being a reserve currency requires that a substantial stock of assets be denominated in that currency. Fifth, and perhaps most telling, during the global financial crisis—whose epicenter was the United States—investors rushed for the safety of the U.S. dollar.”

Krugman draws from Taylor’s article and further questions the merits of the current US NIIP. Conventionally, the deteriorating US NIIP should be obvious, as Krugman indicates “You might be tempted to say that it’s obvious: we’ve been running big budget deficits, borrowing the money from foreigners, so of course our debt to those foreigners is surging. But that story implicitly requires a surge in the trade deficit (or more precisely the current account deficit, which includes investment income), which hasn’t happened.”

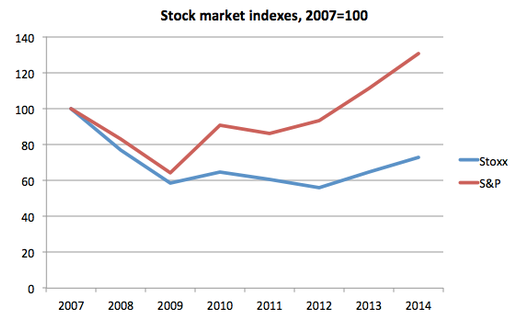

In Krugman’s textbook ‘International Economics (9th edition)‘ (PDF), he discusses the value vs. volume effect on the Balance of Payments and concludes here that similarly here, the difference between the deteriorating NIIP with a stable current account has been a result of the valuation effect. Krugman shows that “a sharp rise in the value of foreign holdings of US equity is not matched by any comparable rise in US holdings of foreign equity.” He believes this differential is a result of the mismatch in performance of stock markets, as his below diagram indicates.

Therefore, Krugman concludes that “the plunge in the US international investment position, far from showing weakness, is actually a symptom of US relative strength, reflected in strong stock prices.” This leaves us with a worrying question, are the US stock markets heading for a dead cat bounce?

Some content on this page was disabled on February 6, 2020 as a result of a DMCA takedown notice from Pearson Education, Inc.. You can learn more about the DMCA here: