This week’s topic:

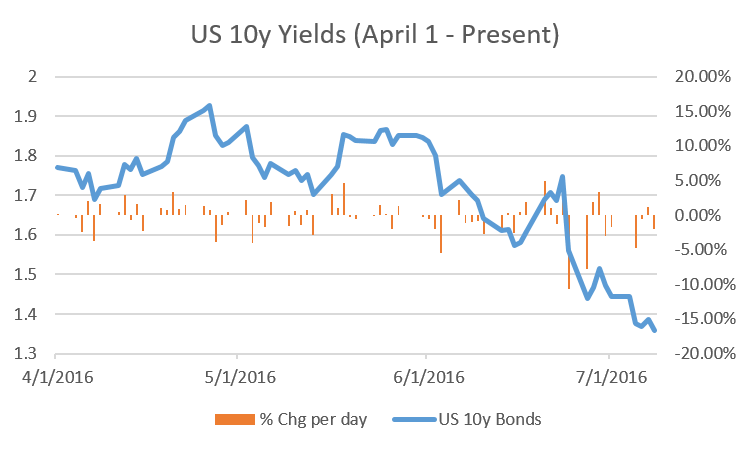

- US government bond yields, can they get much lower?

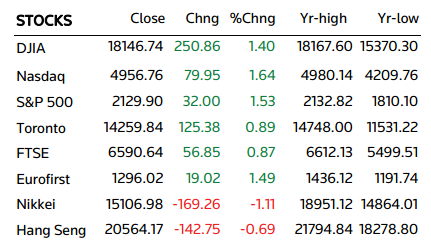

Equity Indices

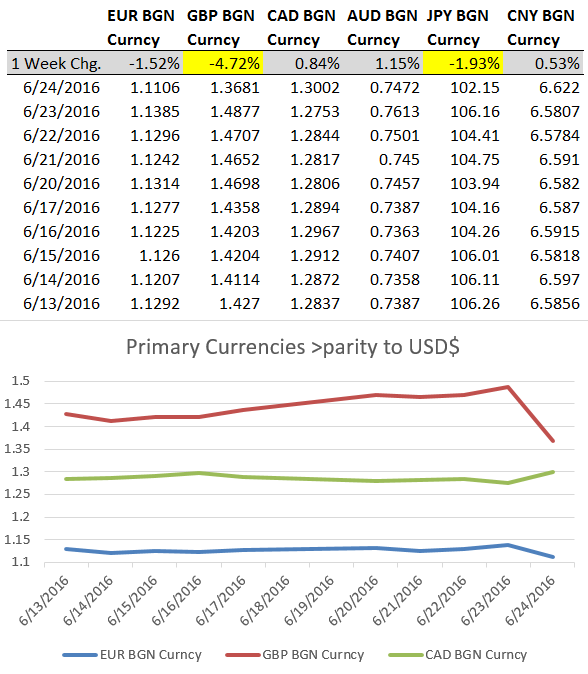

Markets in the East (Australia, China, Hong Kong, Japan) closed lower this week, while markets in the West (London, Toronto, New York) closed much the week stronger.

- New York’s S&P 500 gained 1.28% this week, closing at 2,129.90, a gain on the back of larger than expected NFPs on Friday, closing the index into positive territory having dropped sharply on Monday – Thursday.

- Toronto’s TSX gained 1.39% this week, closing at 14,259.84, a gain mostly achieved by Monday’s close but with the index trailing lower until Thurday, the index didn’t recover until the US NFPs were announced on on Friday.

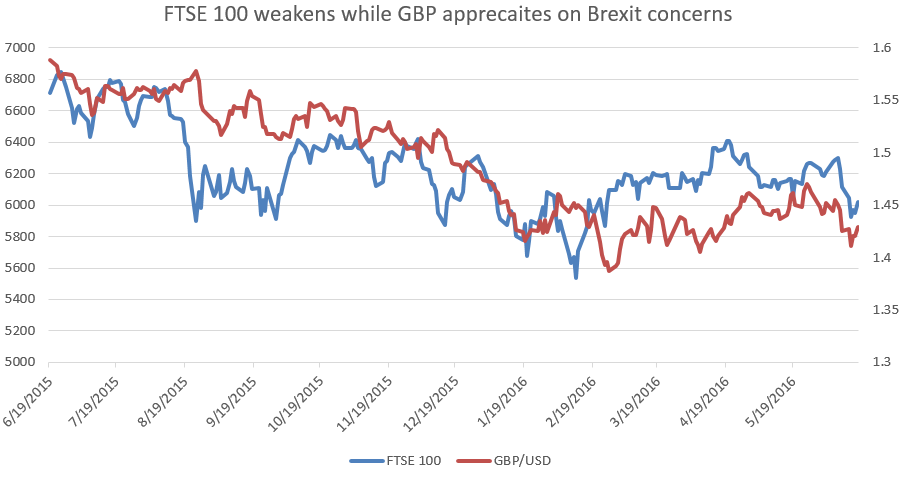

- London’s FTSE 100 gained 0.19% to close at 6,590.64, a gain which recovered early week losses as the Sterling was being hampered in FX markets. The FTSE 100 has recovered 11.26% since June 14th close but has arguably not touched lows reached earlier this year in February at 5,536.97.

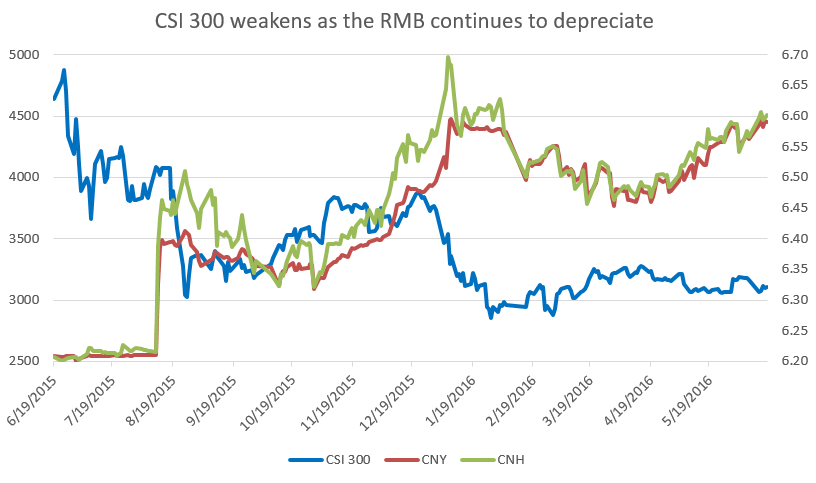

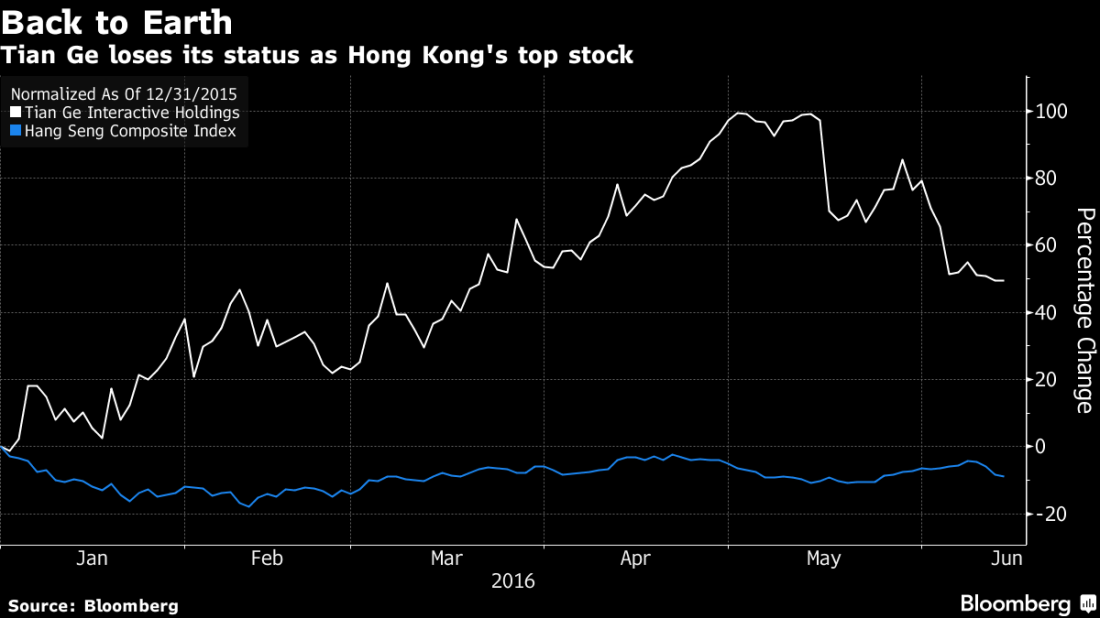

- Hong Kong’s Hang Seng index contracted -1.11% this week to close at 20,564.17, an index level sitting mid-point between 2H2015 and 1H2016. The index could see moves lower as uncertainty over Brexit’s impact on China and Hong Kong are yet to be evaluated.

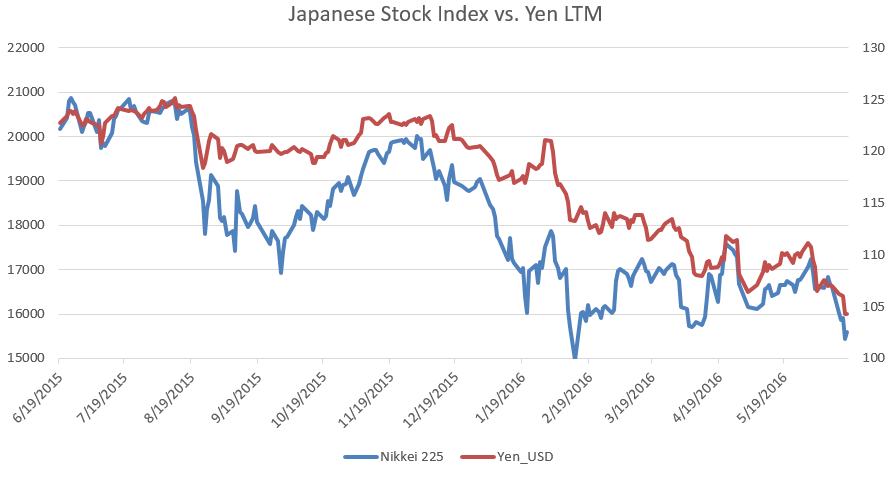

- Tokyo’s Nikkei index contracted -3.67% this week, closing at 15,106.98, a week’s change becoming more common to the Japanese equity market as the previous three Friday closes were +4.89%, -4.15%, -6.03% movements.

Headline Risk-free Rates

- US 10-year yields continued their drop this week, closing at 1.359%

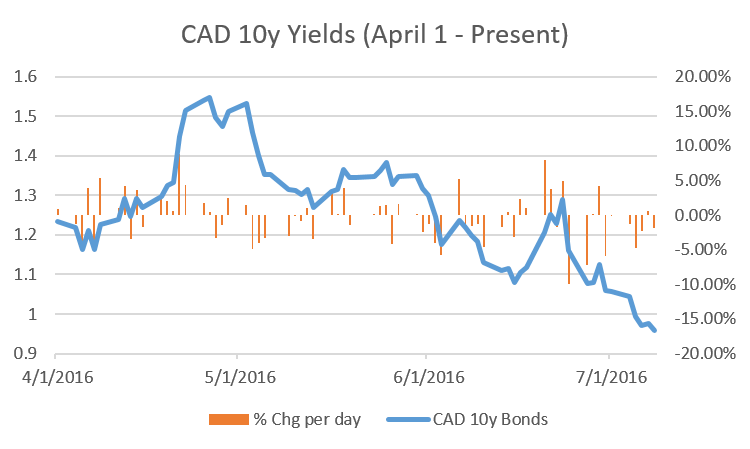

- Canadian 10-year yields dropped back below 1% this week, closing at 0.959%

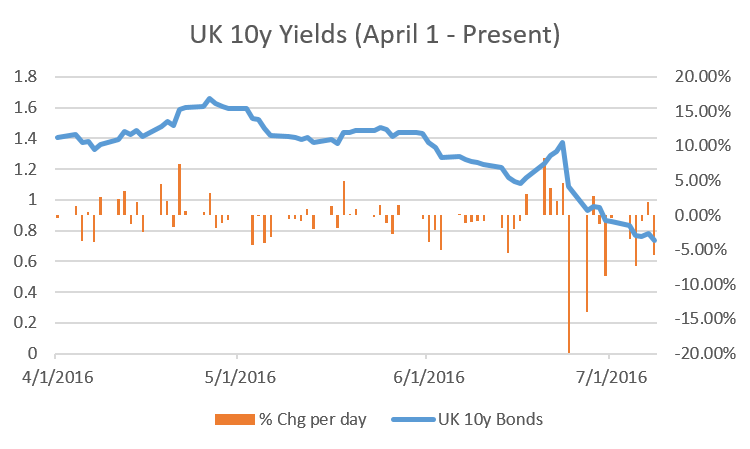

- UK 10-year yields dropped sharply this week to 0.734%

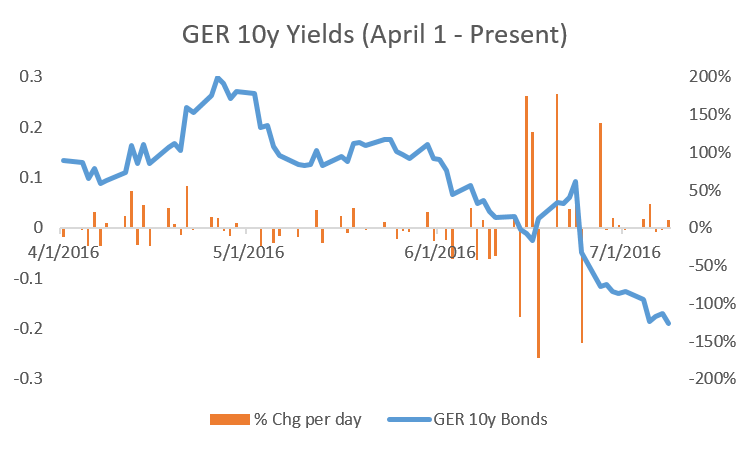

- German 10-year yields continued their slide in negative territory to -0.189%

10-year bond yields – Americas

| CANADA | 0.956 |

| UNITED STATES | 1.363 |

| CHILE | 2.274 |

| PERU | 2.445 |

| MEXICO | 2.846 |

| COLOMBIA | 3.304 |

| CHILE | 4.361 |

| BRAZIL | 4.743 |

| PERU | 5.700 |

| MEXICO | 5.810 |

| COLOMBIA | 7.516 |

| BRAZIL | 12.011 |

| VENEZUELA | 26.215 |

10-year bond yields – Europe

| SWITZERLAND | -0.694 |

| GERMANY | -0.190 |

| LUXEMBOURG | -0.047 |

| DENMARK | -0.010 |

| NETHERLANDS | -0.002 |

| FINLAND | 0.068 |

| AUSTRIA | 0.086 |

| FRANCE | 0.101 |

| SWEDEN | 0.126 |

| BELGIUM | 0.146 |

| CZECH | 0.315 |

| SLOVAKIA | 0.412 |

| IRELAND | 0.418 |

| BRITAIN | 0.732 |

| NORWAY | 0.848 |

| SLOVENIA | 0.938 |

| SPAIN | 1.142 |

| ITALY | 1.190 |

| ISRAEL | 1.590 |

| BULGARIA | 1.960 |

| HUNGARY | 2.810 |

| POLAND | 2.864 |

| PORTUGAL | 3.047 |

| ROMANIA | 3.150 |

| CYPRUS | 3.660 |

| CROATIA | 3.739 |

| TURKEY | 3.886 |

| ICELAND | 5.989 |

| LEBANON | 6.888 |

| GREECE | 7.757 |

| UKRAINE | 8.129 |

| RUSSIA | 8.370 |

| SOUTH AFRICA | 8.691 |

| TURKEY | 8.950 |

10-year bond yields – Asia-Pacific

| JAPAN | -0.283 |

| TAIWAN | 0.661 |

| HONG KONG | 0.829 |

| SOUTH KOREA | 1.369 |

| SINGAPORE | 1.634 |

| THAILAND | 1.848 |

| AUSTRALIA | 1.879 |

| PHILIPPINES | 2.169 |

| NEW ZEALAND | 2.233 |

| CHINA | 2.808 |

| PHILIPPINES | 3.210 |

| INDONESIA | 3.256 |

| MALAYSIA | 3.632 |

| INDONESIA | 7.080 |

| INDIA | 7.385 |

| PAKISTAN | 7.794 |

Risk-Free Rates: Can they get much lower?

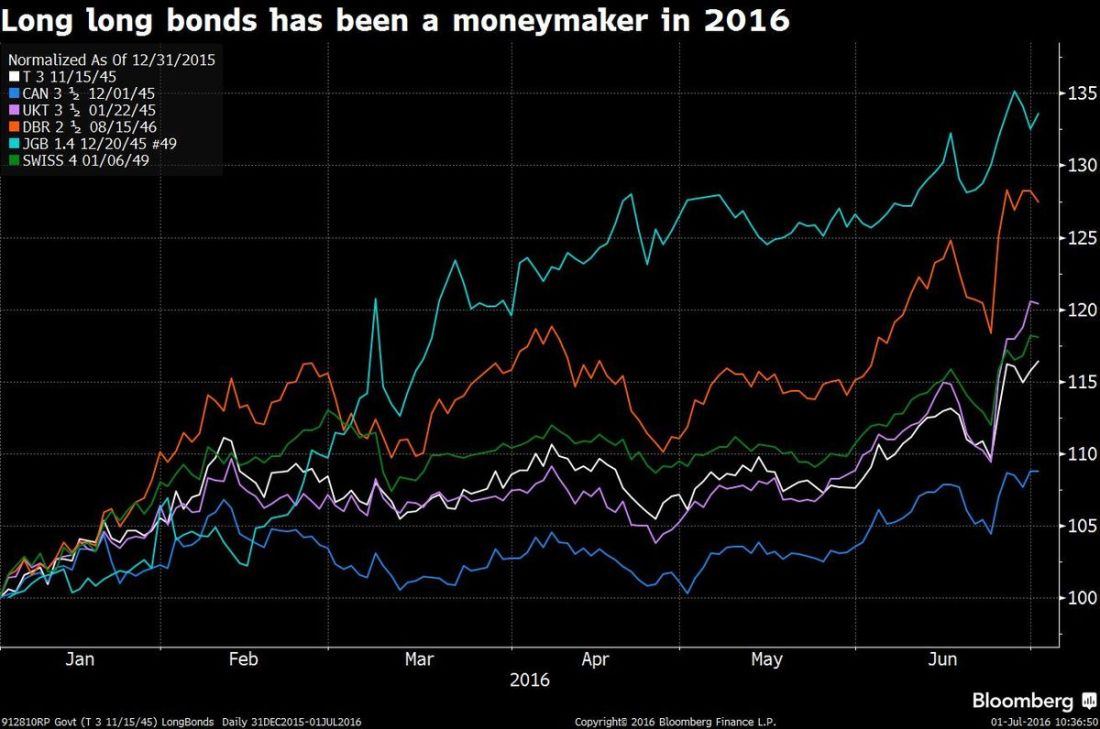

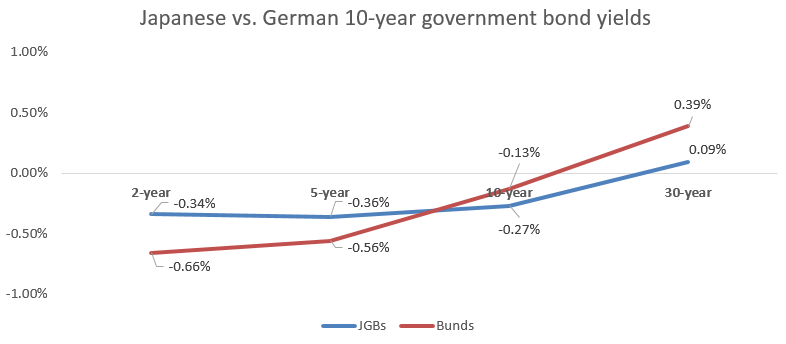

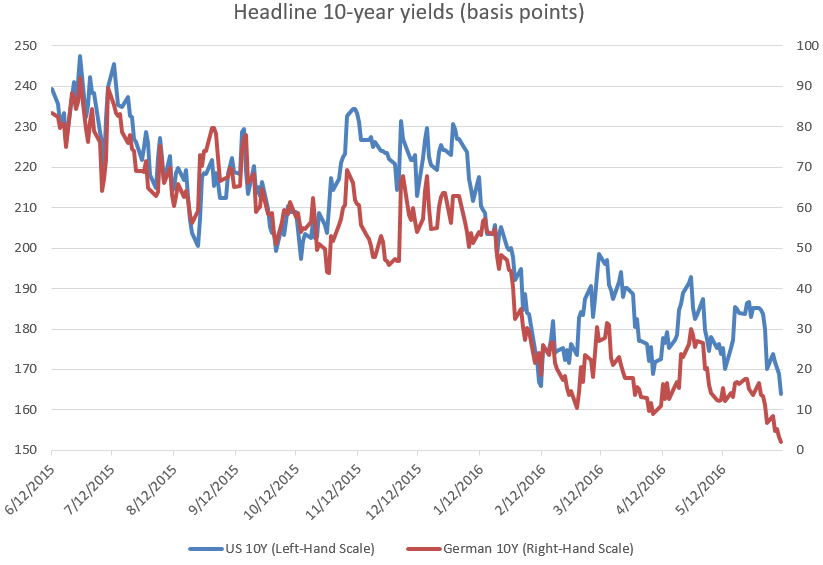

A record decline in US government bond yields, or risk-free rates, has followed a negative trend – similar Germany and Japan – as we face an ever-flattening yield curve. Thus, three things need to be highlighted regarding this movement, as Mohamed El-Erain points out:

Firstly, falling yields and a flattening yield curve (traditionally) would indicate investor expectation of an upcoming recession, yet in reality the data points in the opposite for the US economy.

Institutional holdings of US government bonds have looked to capture the ECB and BoJ stimulus measures as regional economic uncertainty mounts. Brexit adds fuel to the fire as uncertainty builds in already fragile markets, straining Europe-wide economic policy as they face stronger pressure from anti-establishment movements.

This is negative for two reasons: German Bund yields have closed in negative territory for the [second week], which in turn make US government bonds more attractive as US 10-year yields remain above 1.3XX% vs. -0.1XX% for German 10-year bunds.

So long as demand strengthen for US 10y bonds, yield will continue to drop and distort our understanding of risk-free rates.

Secondly, our understanding of risk-free rates has allowed us to build a model for equity valuations, primarily through WACC. However, dysfunctional advanced economies’ risk-free rates could have serious consequences on the stability of future equity values.

A worsened outlook on financial institution profitability complicates the situation as banks function as credit intermediaries, a cog imperative to our credit cycle. If economic growth continues to slow, banks will face increasing pressure to lend as the quality of their loan portfolios deteriorate further.

Lastly, the Federal Reserve, particularly the FOMC, has become the focus of investment attention as the pace at which the Funds Rate ‘normalizes’ is seen as an investment proxy to economic health, particularly that of the States.

The Federal Reserve controls the Federal Funds Rate, an interest rate used in the overnight lending market (Primer on Federal Reserve). Traditionally, the FOMC would change the Funds Rate and indicate its forecast for inflation and economic growth; however, the FOMC enacted a large-scale asset repurchase (Quantitative Easing) program in which it’s SOMA and Fed NY Desk stands to buy and sell securities (primarily bonds) in the market. This false demand affects the underlying interest rate.

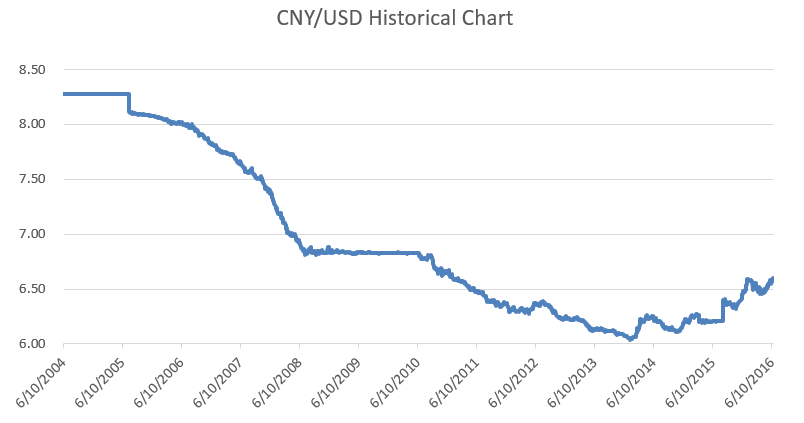

The FOMC is being increasingly burdened by uncertainty, from the slowdown in Chinese economic growth to the UK’s referendum, and as the FOMC maintains a Funds Rate will increase over time stance, capital flight will be the primary concern for institutional investors.

So what is the implication?

Asset price inflation.

Low/negative government policy rates have led to lower/negative government bond yields as investors price a low-to-negative real growth (nominal – inflation) in the short-term with long-term government bonds continuing to yield positive, albeit in the decimal places.

The Danish Krone, Swiss Franc, Japanese Yen, and Euro policy rates are all in negative interest rate territory.

Low interest rates meant to stimulate borrowing is to be used for investment purposes. This maintains a Keynesian view of the economy in that aggregate demand (total spending) will generate greater output, i.e. GDP; however, the reality has been quite different.

Lower interest rates have led to higher equity valuations as companies borrow money to pay dividends, stock buybacks, or simply hold cash & equivalents. Higher equity valuations result in higher equity risk premiums, as the spread between expected return on equity and expected cost of capital widens. Furthermore, as low to negative interest rates signify low to negative real economic growth, the current risk free rate should be used a cap on the perpetuity growth method and thus reflect a lower present value.

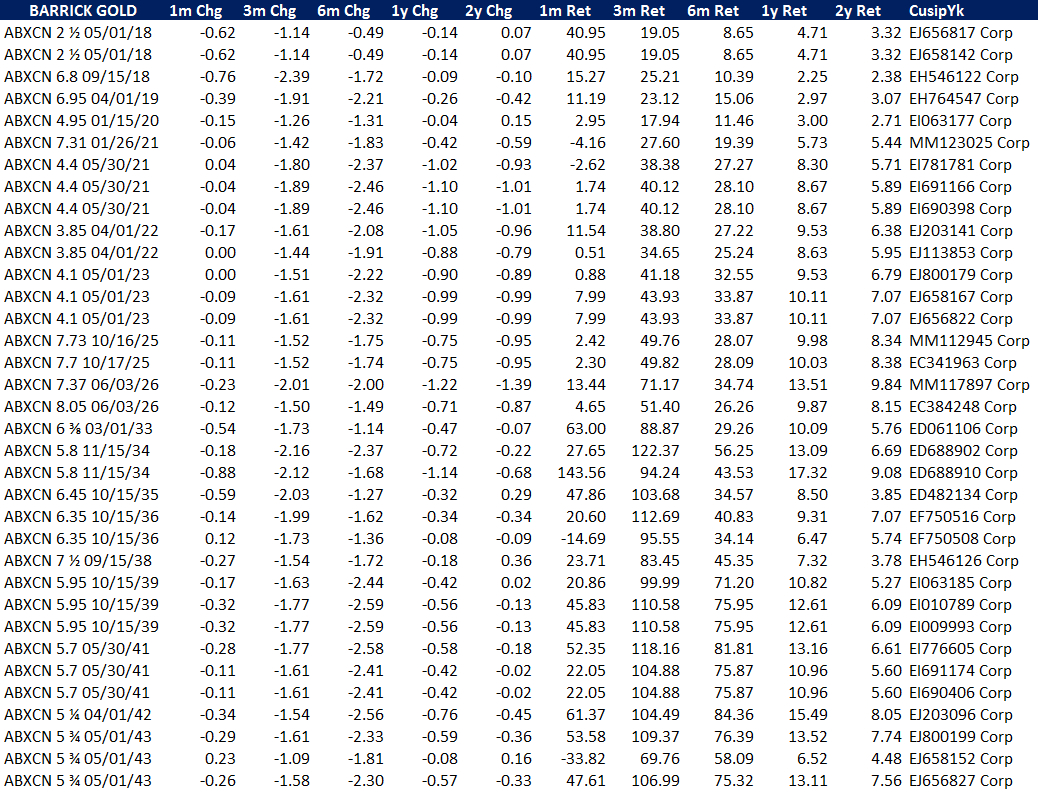

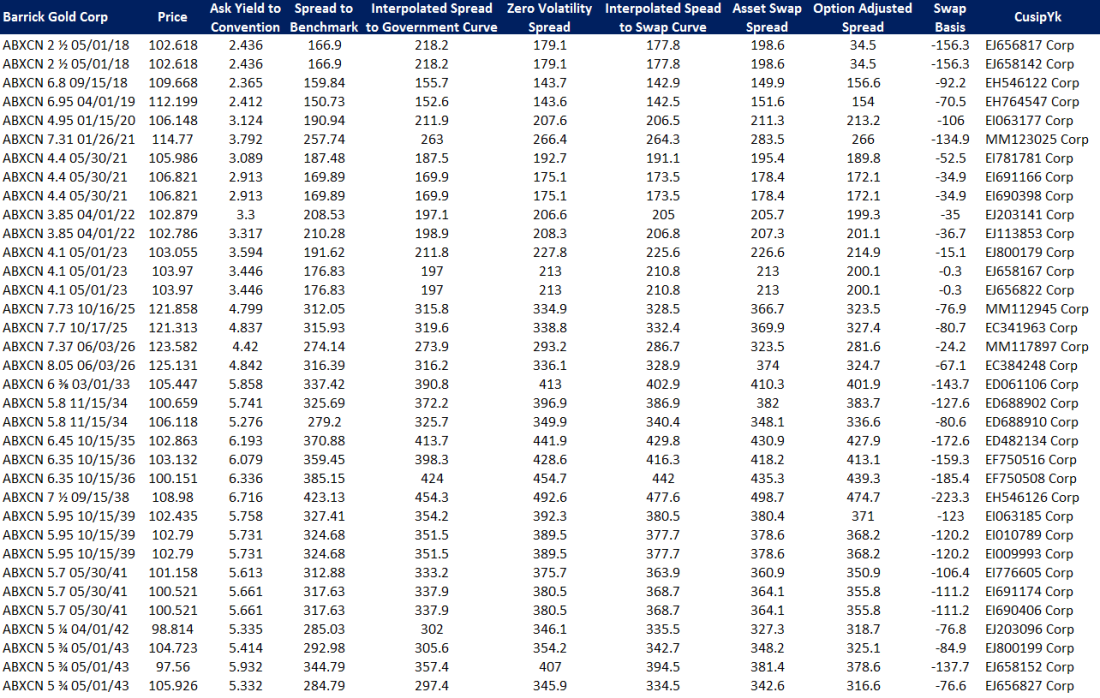

Barrick Gold’s yield curve was self-created and is not a standard function as part of Bloomberg Terminal.

Barrick Gold’s yield curve was self-created and is not a standard function as part of Bloomberg Terminal.